Past investment performance does not indicate or guarantee future success. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. For example, use the 20-day EMA line to determine the bottom and the 20-day MA line to determine the top. Use EMA to buy the dip and MA to recognize the peak.If the 5-day EMA line crosses or breaks the 20-day EMA line, it will be viewed as a mid to short-term trend the 10-day EMA line crosses or breaks the 10-day EMA line, it will be viewed as a mid to long-term trend.20-day EMA line crossing above the 60-day EMA line is a long-term buy signal breaking below the 60-day EMA line is a long-term selling signal.10-day EMA crossing above the 20-day EMA line is a mid-term buy signal breaking below the 20-day EMA line is a mid-term sell signal.5-day EMA crossing above the 10-day EMA line is a short-term buy signal breaking the below the 10-day EMA line is a short-term selling signal.

Among them, the 60-day EMA line is the critical turning point for bull and bear.

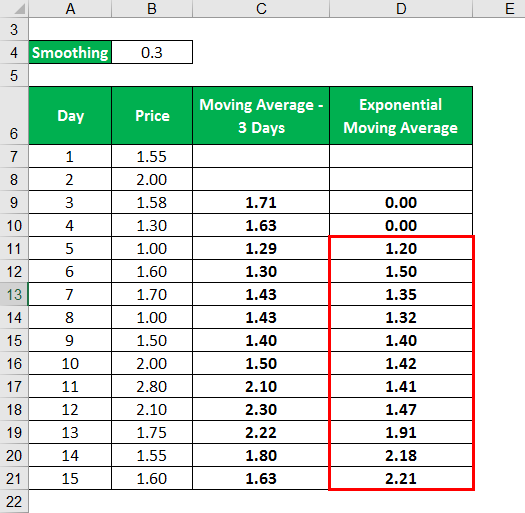

Index average value of the day = Smoothing coefficient * (Index value of the day - Yesterday’s index average) + Yesterday’s index average Smoothing coefficient = 2 / (period unit + 1) Derived from the above formula, we get: EMA (N) = 2 * X / (N+1) + (N-1) * EMA (N-1) / (N+1). Where X is the closing price of the day and N is the number of days. EMA5, EMA10, EMA20, EMA60, EMA120, EMA250 correspond to the exponential smoothing moving averages of 5, 10, 20, 60, 120, and 250 respectively.įind the N-day exponential moving average of X, which is generally expressed as: EMA (X, N) in the stock formula. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period. The exponential moving average is also referred to as the exponentially weighted moving average. An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points.

0 kommentar(er)

0 kommentar(er)